Lessons from the IFRS 17 dry runs

Estimated reading time: 4 minutes

How PwC’s Managed Service and wider support can help you avoid the practical challenges

PwC’s IFRS 17 Managed Service team supported several clients with end-to-end IFRS 17 dry runs during the last quarter of 2021. The motivation for these included:

- helping clients who had signed up for our Managed Service offering familiarise themselves with our process and our IFRS 17 Solved solution;

- testing the readiness of systems and processes; and

- meeting regulators’ dry run requirements.

With the IFRS 17 go-live date less than a year away, the dry runs helped our clients identify any gaps in and issues with their data, systems, processes and controls; put their IFRS 17 designs to the test; and objectively assess their progress and readiness.

Despite the fact that our clients span different regions, cover life and non-life business, and have different objectives for their IFRS 17 implementation programmes, the themes that emerged were remarkably similar. Two overarching messages were:

“IFRS 17 is complex, even for the simplest of insurers. We underestimated the work we need to do when moving from design into the implementation phase.”

“We overestimated the ‘plug and play’ readiness of third-party vendor solutions. There’s still a lot of work for us to do, to get relevant data into the solution, as well as to configure and run the solution.”

Even if you’re not yet at the dry run stage, we’re sure that the key insights shared in this blog will benefit anyone on the IFRS 17 journey. Whether you’re still in the early stages of the implementation journey, or have encountered major setbacks or obstacles, we share how our IFRS 17 Managed Service offering, and our deep implementation experience, can help you avoid or solve even the biggest challenges.

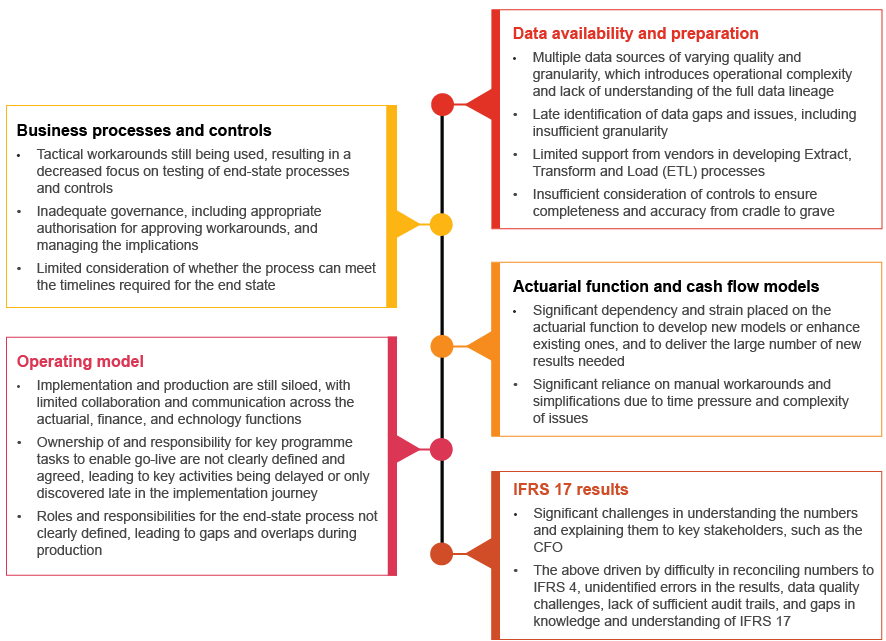

The diagram below summarises the key challenges identified during the dry runs.

Our services and solutions can help you to address each of these challenges as follows:

PwC’s IFRS 17 Managed Service

Our IFRS 17 Managed Service provides all the results you need for IFRS 17 reporting (calculation engine, journal entries and all quantitative disclosures) on the basis of data that you provide. It’s run by our global IFRS 17 experts on a cloud-based IT solution, IFRS 17 Solved, which is pre-built, fully configured, fully compliant and independently tested. It’s cost-effective, easy to implement, and integrates with your current systems. In addition, it de-risks your programme, provides an immediately available Plan B solution where needed, and frees you up to continue modernising your actuarial and finance functions and resolving your unique data and governance challenges.

IFRS 17 Solved’s pre-specified data dictionary simplifies and speeds up the process of identifying data requirements and developing your end-to-end data model, helping you avoid getting lost in the spaghetti of data that feeds the IFRS 17 process. You’ll avoid the control and integration challenges for the part of the process that our Managed Service covers.

Data and control environment

The early identification and remediation of data and integration challenges, as well as a healthy control environment, underpin the success of an IFRS 17 implementation.

We offer assessment, advice/recommendations, and independent testing of the data ETL approach and overall data lineage. This helps drive completeness at the input and output stages of the IFRS 17 calculation process. Our assessments also include a review of the design of your key controls, and identification of key automation opportunities to deliver a robust and repeatable process.

Actuarial function modernisation

In addition to the demands of IFRS 17 on the actuarial function, there’s also increased demand from key stakeholders for automation, as well as relevant and useful insights. PwC can support you in meeting these demands, with our:

- proprietary cloud-based reserving app, which helps modernise short-term insurance actuarial valuations;

- track record of assisting various insurers with a wide range of actuarial needs, such as reserving, capital management, model risk management, reinsurance optimisation and pricing; and

- experienced interdisciplinary team of subject matter specialists (actuarial, IT and finance) who work together to provide holistic and practical solutions.

Operating model

We use our extensive IFRS17 experience and broad capabilities (actuarial, finance and technology) to share independent perspectives and assist you in defining your IFRS 17 operating model across people, process and technology. We aim to ensure:

- a collaborative approach to IFRS 17 compliance by the actuarial, finance and technology functions;

- clear ownership and responsibilities within the end-to-end process; and

- a robust governance and control environment for BAU operations.

Wider implementation support

Wider implementation support (in conjunction with our IFRS 17 Managed Service or on a stand-alone basis) includes:

- supporting your teams in performing dry runs, running transition numbers and producing comparatives (this is included as standard under the Managed Service);

- assisting your teams to understand and explain the numbers; and

- providing training at every level (Board, executives, at an operational level, and wider stakeholders).

These dry runs helped our clients identify any gaps in and issues with their data, systems, processes and controls; put their IFRS 17 designs to the test; and objectively assess their progress and readiness.

Contact us

Carolyn Clark

Principal | Actuarial, Risk and Quants, PwC South Africa

Tel: +27 (0)21 529 2634