For the third consecutive year, PwC has collaborated with DataEQ to benchmark consumer sentiment on social media towards 15 of South Africa’s major insurers.

In an environment characterised by increased consumer scrutiny and a rapidly evolving digital landscape, insurance emerged with a positive Net Sentiment that outshone other FSP industries measured by DataEQ.

This year’s index tracked over 530 000 public non-enterprise posts across X (formerly known as Twitter), Hellopeter, and other online sources for the period of 1 April 2022 to 31 March 2023. These posts were then processed using DataEQ’s unique Crowd and AI technology.

One of the key highlights of this year has been the dramatic improvement in customer service sentiment, an aspect that rebounded from -68.1% Net Sentiment in 2022 to a commendable +25.3%. This report delves into the reasons for this impressive swing, including increased praise for staff on Hellopeter as a result of the efforts insurers have made to improve online responsiveness.

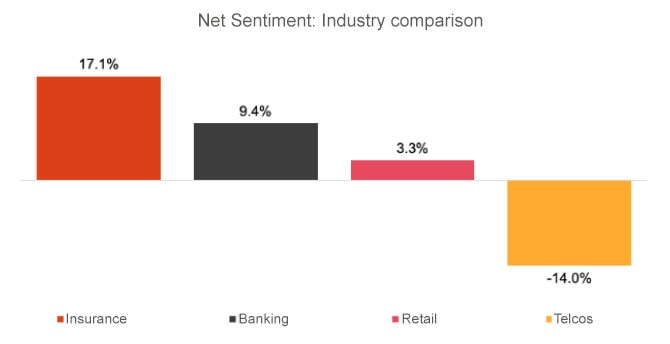

Insurance industry leads in Net Sentiment

The South African insurance industry set the benchmark for Net Sentiment, outshining banking, retail, and telecommunications. Year-on-year data showed that the insurance industry demonstrated significant improvement from -0.4% Net Sentiment in 2021, to a positive 6.8% Net Sentiment in 2022, and then rose even higher to a 16.1% Net Sentiment score in 2023.

Contact us

Courtney Milne

Manager | Experience, Data Insights & Technology, PwC South Africa

Tel: +27 (0) 83 601 0495