Tax and Legal Services Performance Summary

Tax and Legal Services have made significant strides to drive profitable growth, cost discipline and efficiency.

Tax and Legal Services

“The environment in which Tax and Legal Services (TLS) operates is evolving rapidly. Technology is disrupting our business and tax authorities are themselves building technological capabilities at a rate never before seen. We continue to respond to these and other challenges while striving to make the most of emerging opportunities, particularly in the area of technology.”

Tax policy, tax competition and continued misconceptions about the differences between tax avoidance and tax evasion continue to create significant complexity and risk for our clients. At the same time, increasing regulation and legislative changes across the globe are further amplifying the level of complexity and risk both we and our clients are facing. We continue to respond to these and other challenges while striving to make the most of emerging opportunities, particularly in the area of technology. With our goal being to free up 20% of our hours by using digital tools and changing the way we operate certain functions of our business, we made positive progress this year in a number of areas:

- Improved operational efficiency and team stability

- Digital upskilling and roll out of digital tools and platforms

- Implementation of our demand creation tracker

- Sharing insights to help clients and the public navigate COVID-19 relief measures

Financial results - revenue

Delivering our strategy

- Quality

- Sharpen our market focus

- Being commercial

- Digitising our business

- Inspiring our people

- Greater societal purpose

Quality

In this challenging environment, staying true to our Purpose — to build trust in society and solve important problems — is critical to our strategy of remaining relevant, and delivering quality is paramount to achieving our objectives.

To achieve our quality objectives, we have implemented and are continuously monitoring robust quality and risk management policies, and practices. These include:

- The Global Tax Policy Panel, made up of a number of experienced senior partners, which enables us to critically review engagements, engagement compliance and quality reviews. The panel reviews all potential TLS engagements that have high risk indications such as contingent fees, policy lobbying, work for the government and/or significant fees.

- The roll out of PwC’s global Tax Quality Management System. The system safeguards quality in Tax and Legal Services across all PwC member firms.

- The Global Tax Code of Conduct for the global PwC network,which guides us with regard to the clients and engagements we accept and how we deliver our work — and always complying with the overarching principle of quality.

- The establishment of the Horizon Risk Management Service Delivery Centre, made up of specialists in their field, has strengthened the quality and efficiency of our risk management function.

- Our CoE and SDCs, which enhance specialisation and focus across our functions.

- Training and upskilling our people.

- Business unit reviews. Reviews conducted this year of our Corporate and International Tax and Transfer Pricing departments in Gauteng and the Western Cape identified no major concerns.

Sharpen our market focus

Our strategy is to focus our resources in the areas most relevant to our clients’ current and future taxation needs. This year we prioritised developing greater industry collaboration and working more closely with the Assurance and Advisory lines of service to offer holistic client solutions.

The launch and use of TLS Salesforce dashboards, and monthly ‘Winning Ways’ reporting, has sharpened our awareness of clients’ short-and long-term needs, thereby enhancing a greater sales orientation in our practice and facilitating more efficient planning and resource allocation.

Our new Demand Creation Platform puts the spotlight on the intersection between industry trends and important legislative developments. It’s value was demonstrated during the COVID-19 pandemic, when the platform enabled us to swiftly assist clients interpret and implement the tax relief measures enacted by the Government.

Our Horizon Service Delivery Centre, meanwhile, has lightened the administrative burden on our client-facing staff, enabling them to dedicate more of their time to achieving our market focus priorities.

We will continue to embed an enhanced sales culture in the coming year, walking the journey with our clients and staying close to what matters to them. We will pursue our industry focus with dedicated account drivers to support our firmwide industry and priority accounts programme to ensure that our clients continue to access relevant and industry-specific insights and service offerings.

Being commercial

We have made significant strides to drive profitable growth, cost discipline and efficiency through the adoption of Salesforce and its integration with our Horizon Service Delivery Centre and Demand Creation Platform. This ensures that all opportunities within the TLS practice are loaded and tracked on Salesforce through the pursuit process, giving us a better line of sight and understanding of our pipeline. Widespread adoption of Salesforce (±85% in 2020) ensures that the benefits of these initiatives are driven across our business.

In terms of cost and efficiency, our tax CoE and SDCs enabled us to compete effectively in low-margin areas, while the Horizon SDC has introduced a standardised, simplified and more efficient and cost effective risk management process. This has significantly improved our operational efficiency and improved our credit control processes, enabling more seamless interactions with clients.

We will continue this journey in FY21 to put more hours in our CoE and SDCs. It is through the use of CoEs and SDCs that we continue to create capacity for value add services to our clients.

Digitising our business

We continue to embrace new technology to drive improvements in the quality, service and value we can offer our clients and the career paths we can offer our people.

This year we introduced PowerBI, a cloud-based business intelligence and data analytics service to our business to enhance our internal and client-facing capabilities. We now use PowerBI dashboards to monitor our financial performance and Salesforce pipeline information to deliver valuable metrics and insights such as net revenue, planned variances, billing variances, recoverability and product splits.

The dashboards are with all TLS leadership to ensure transparency and encourage teamwork. They have helped us to manage our capacity better and channel our resources to where our clients need them most.

Our Horizon SDC has enabled us to digitise many of our internal processes to conduct risk management. This has streamlined our internal processes and freed up client-facing staff’s time to focus on better client service delivery.

We continue to deploy digital tools as they become available, both to improve efficiencies and also to improve client satisfaction.

Inspiring our people

Roll out of our SDC and CoE programme has reduced the clerical burden placed on our professional staff as well as creating new career options and opportunities for our non client-facing staff.

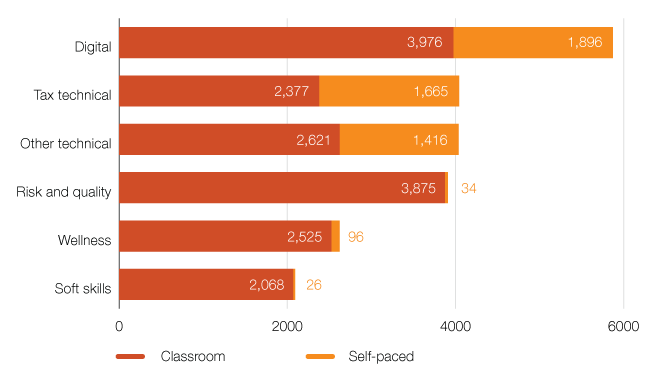

Providing our staff with fulfilling careers and continuous development opportunities is an important aspect of our commitment to them and to our clients. During the year, 23 000 hours were dedicated to training, which is summarised in the accompanying graph.

Greater societal purpose

Through our various thought leadership initiatives, we contribute to research and the public debate on various important societal issues.

For example, our Taxing Times survey contributes to improving the tax system by providing a platform for corporate taxpayers to share their experiences, perceptions and needs with regard to their dealings with the South African Revenue Service (SARS) in tax disputes.

The results of our research are shared with SARS to help improve service delivery and customer relations. This initiative also assists clients and other corporate taxpayers to better understand the regulatory landscape and thus helps them to improve their compliance and engagement with SARS.

Our Building Public Trust through Tax Transparency initiative encourages and promotes greater voluntary transparency in tax reporting and recognises the listed companies that are best using voluntary tax disclosure to tell their stories, thereby demonstrating good corporate citizenship as responsible taxpayers.

Other areas in which TLS contributed to the firm’s commitment to supporting growth and development include contributing to programmes such as Business Unity South Africa, Business for South Africa and the COVID-19 Solidarity Fund.

COVID-19 As the firm is well advanced in its digital transformation journey, TLS was able to transition seamlessly from business as usual to working from home at the start of the national lockdown. In fact, the level of collaboration on our digital platforms was elevated and productivity improved compared to the period before the lockdown. Tax and other regulatory relief measures introduced to relieve the impact of the pandemic and lockdown were a challenge for many organisations to navigate. We stayed close to COVID-19 specific tax legislation and helped guide our clients as the situation developed. We also produced a number of COVID-19 related publications in the public interest and contributed to PwC’s global webpage dedicated to the impact of the pandemic: Navigate Tax, Legal and Economic Measures in response to COVID-19.

Contact us

Verena Koobair

Head of Communications and Societal Purpose Firm Pillar Lead, PwC South Africa

Tel: +27 (0) 11 797 4873